There was a time when opening a bank account meant dressing up, sitting in a brick‑and‑mortar bank, and awkwardly smiling while waiting for what felt like forever. Fast forward to today, and you can open an account online in minutes from your laptop or phone, whether you’re a startup founder, freelancer, or small business owner.

This shift from traditional banking to online banks reflects how banking services have changed. Online banks offer faster setup, better interest rate options, lower fees, and tools built for people who want control of their money without waiting in line.

In this article, we’ll cover the 10 best online banks of 2026, explain what makes each one worth considering, and help you find the best fit for your needs.

Let’s dive in.

Why Online Banks Matter in 2026

Online banking isn’t a trend, it’s become a core part of how most entrepreneurs manage money. The best online bank understands that you don’t want to jump through hoops just to check a balance, transfer funds, or open a savings account.

Online banks are also safe. They’re typically insured just like traditional banks, and many offer better interest rates on savings accounts and checking accounts than their older counterparts.

But with so many options, choosing the right one can feel overwhelming. That’s why we’re breaking down the 10 best online banks and explaining what makes each one stand out.

Interest Rate

Before we walk through the list, let’s talk about something that really sets online banks apart: interest rate.

The best online banks of 2026 often offer high‑yield savings accounts, meaning your cash actually earns something, not just sits there collecting dust. That’s a huge win for startups and freelancers who want every dollar to work for them.

Traditional banks often offer low interest rates on savings accounts, whereas online banks tend to give you a better return with fewer fees or minimum balances.

Now let’s look at the top picks.

Best Online Banks of 2026

1. Wise Business

Wise is one of the most popular online banks for startups that work internationally.

It’s ideal if you’re dealing with payments from around the world, need multi‑currency accounts, or want to send and receive money without absurd fees.

Why Wise stands out:

- Local bank details in multiple currencies

- Lower cost international transfers

- Transparent fees

Wise isn’t a traditional bank with branches, but many startups choose it because online banks offer tools that traditional banks simply don’t.

2. Revolut Business

Revolut is a strong contender for anyone looking for a full suite of banking products and services online.

It combines checking, savings, team cards, international transfers, analytics, and more. For a business owner juggling clients and bills, this can be incredibly useful.

What Revolut Business offers:

- Multi‑currency accounts

- Expense cards for your team

- Analytics tools

- Optional lending and credit

In the realm of banks of 2026, Revolut has become a go‑to for companies that want everything in one, easy online bank account.

3. Payoneer

Payoneer has carved out a niche as one of the best online banks for freelancers and sellers on global platforms like Amazon, Upwork, and Fiverr.

Rather than being a traditional bank, it’s a payments platform that also provides local account access and smart tools to get paid across borders.

Why startups and freelancers like Payoneer:

- Local receiving accounts in USD, EUR, GBP, etc.

- Works well with marketplaces

- Easy to manage cash flow

If you want financial services that work with the freelance economy, this online bank offering is worth exploring.

4. Vivid

Vivid is one of the newer names in the banks of 2026 space, and it’s gained traction for its simplicity and modern features.

It’s particularly popular among EU‑based freelancers and entrepreneurs who want a mobile‑first online bank account without the hassle and complexity of some bigger providers.

Vivid highlights:

- Multi‑currency accounts

- Cashback on spending

- Smooth mobile experience

Vivid might not provide every banking product under the sun, but for a startup checking and savings account that’s refreshingly straightforward, it’s a solid pick.

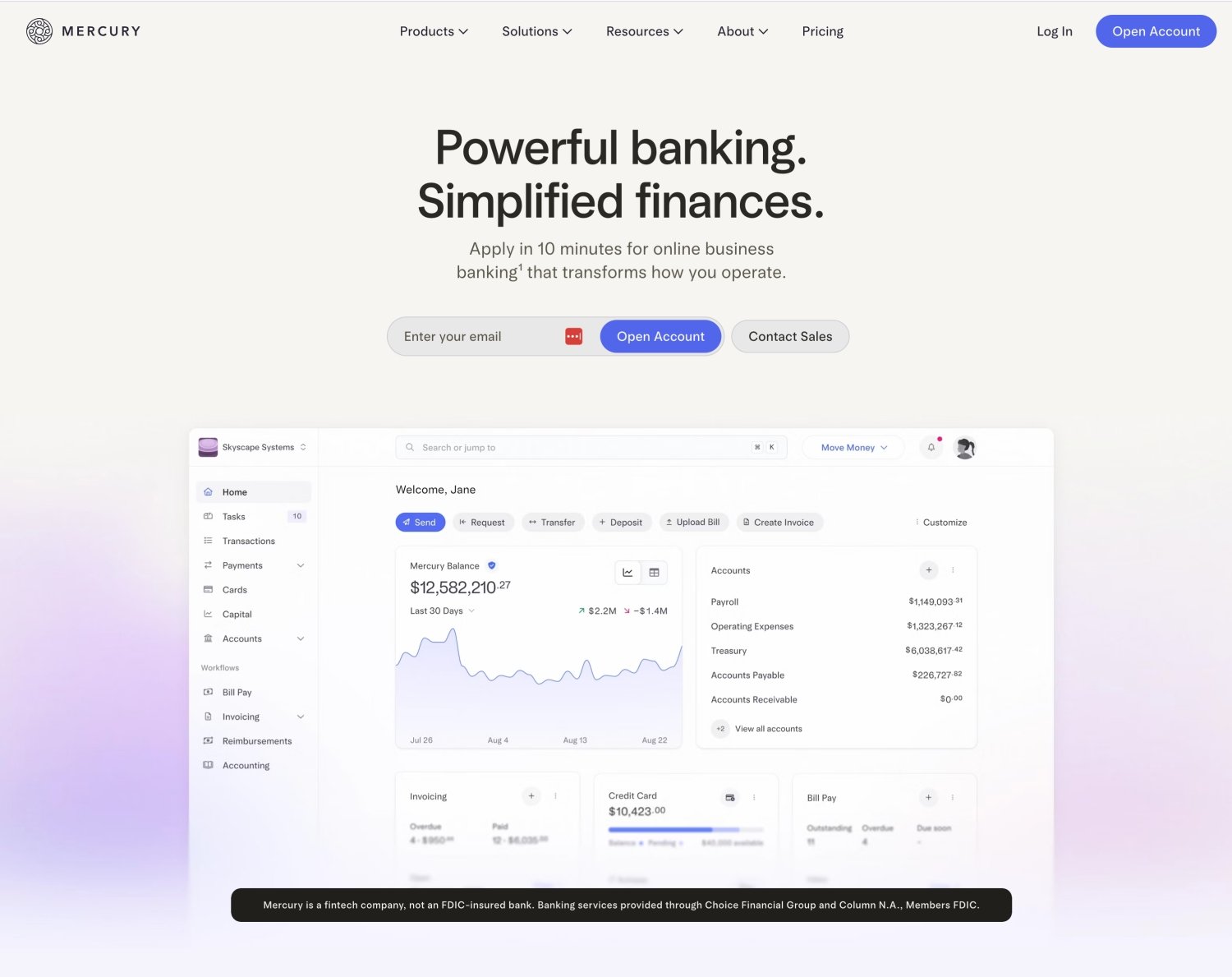

5. Mercury

Mercury often comes up when founders ask “which online bank should I use for my startup?”, especially tech startups.

It’s not just an online bank; it’s built specifically with startups, SaaS founders, and venture‑backed companies in mind.

Mercury perks:

- FDIC‑insured accounts

- Integrations with Stripe, QuickBooks, and others

- Tailored tools for founders

If you’re based in the U.S. and want an online bank account that feels built for a startup rather than a personal account repackaged for business, Mercury is definitely one of the top online banks this year.

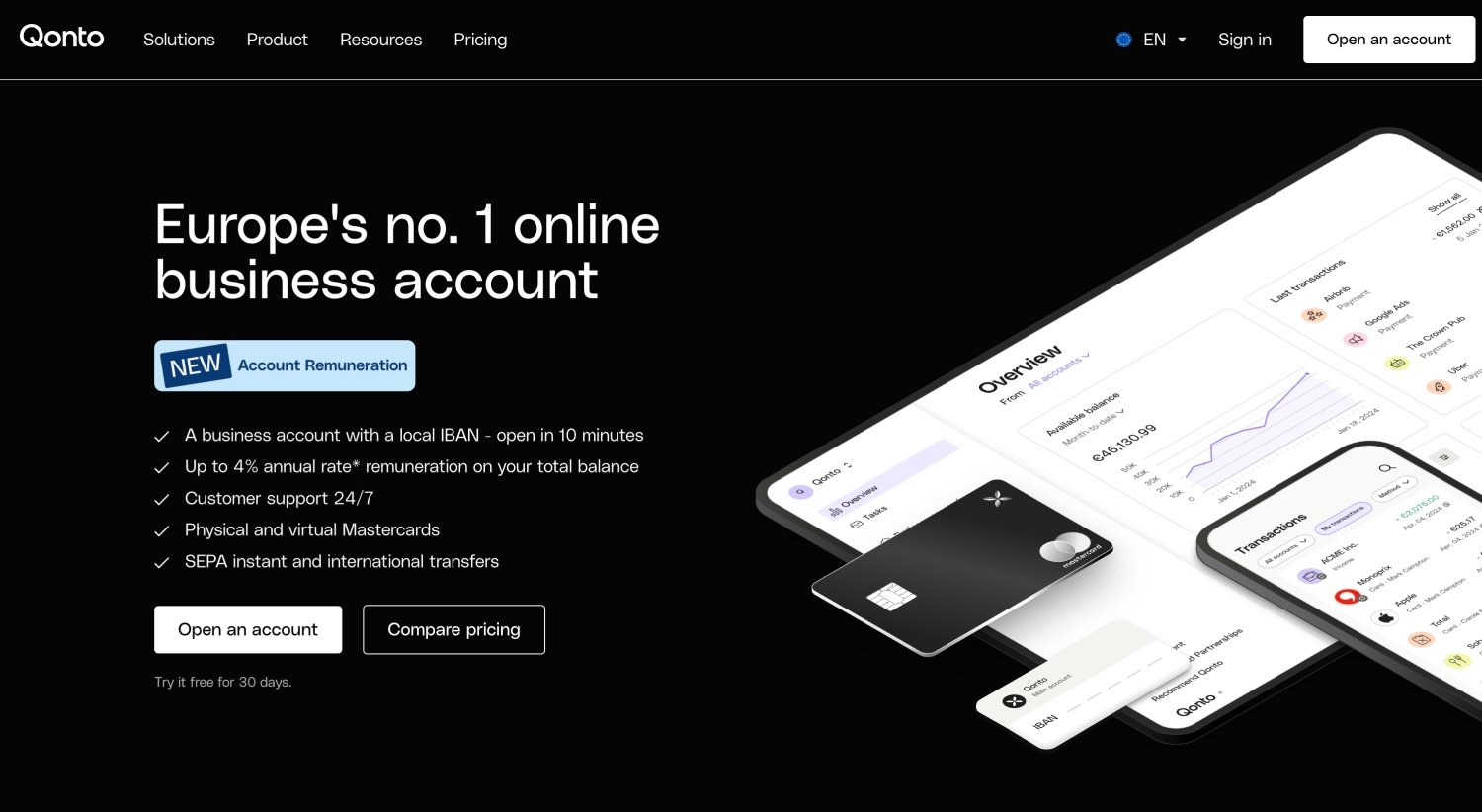

6. Qonto

Qonto is one of the rising stars in Europe’s online banking scene. It’s designed to replace traditional banking for small businesses and freelancers.

From checking accounts to expense management and team access, it’s a neat package.

Qonto features:

- Business checking and debit cards

- Expense and team tracking

- Easy accounting integrations

If you’re in the EU and want an online bank account that feels more polished than many legacy options, Qonto is worth a look.

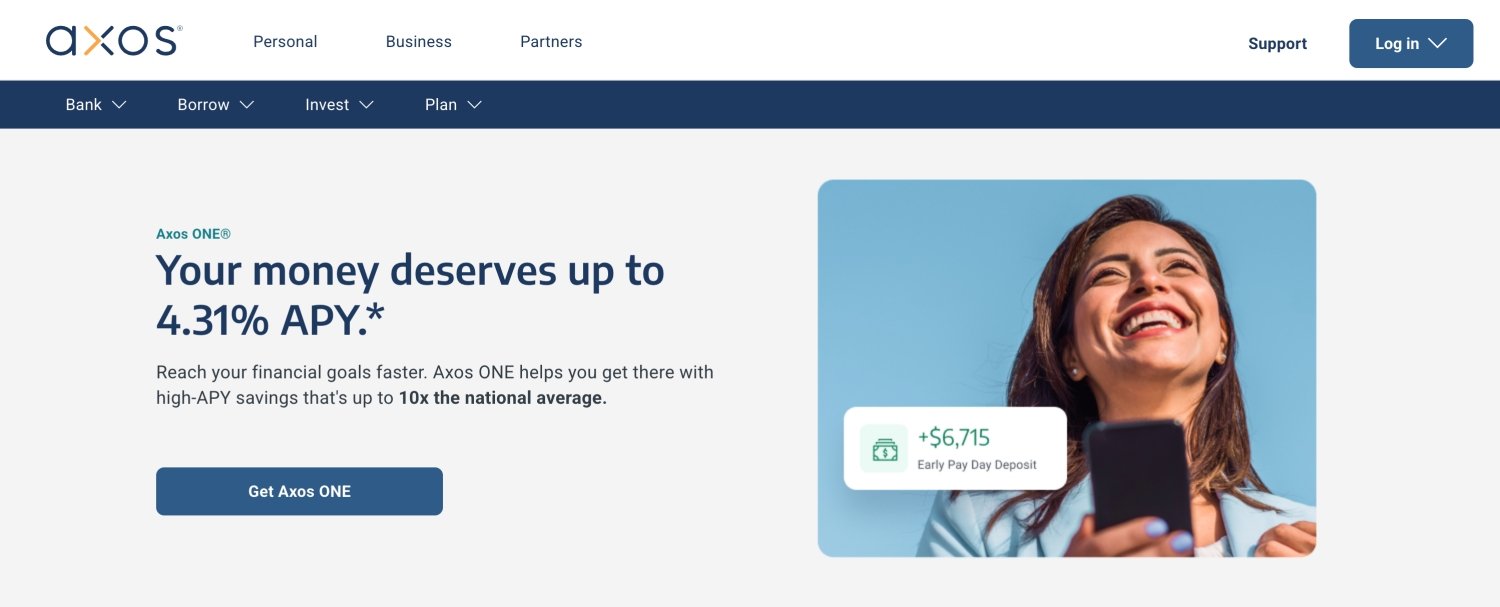

8. Axos Bank

Axos Bank has quietly become one of the best online banks for small business owners who want checking and savings account options in one place.

It feels familiar, like a traditional bank, but with all the convenience of digital banking.

Axos perks include:

- Business checking account with tiered options

- Savings and money market accounts

- No monthly maintenance fees on select accounts

If you want a more full‑featured online bank (but still don’t want to deal with a physical branch), Axos is a name to consider.

9. First Internet Bank

First Internet Bank has been around for a while and specializes in online savings accounts and high‑quality banking products.

It’s especially strong if you’re focused on building reserve funds while keeping your money accessible.

Key benefits:

- Competitive interest rate on savings

- Strong security and customer service

- Easy online setup

If your priority is a high‑yield online savings account and clean digital experience, this bank might be your best fit.

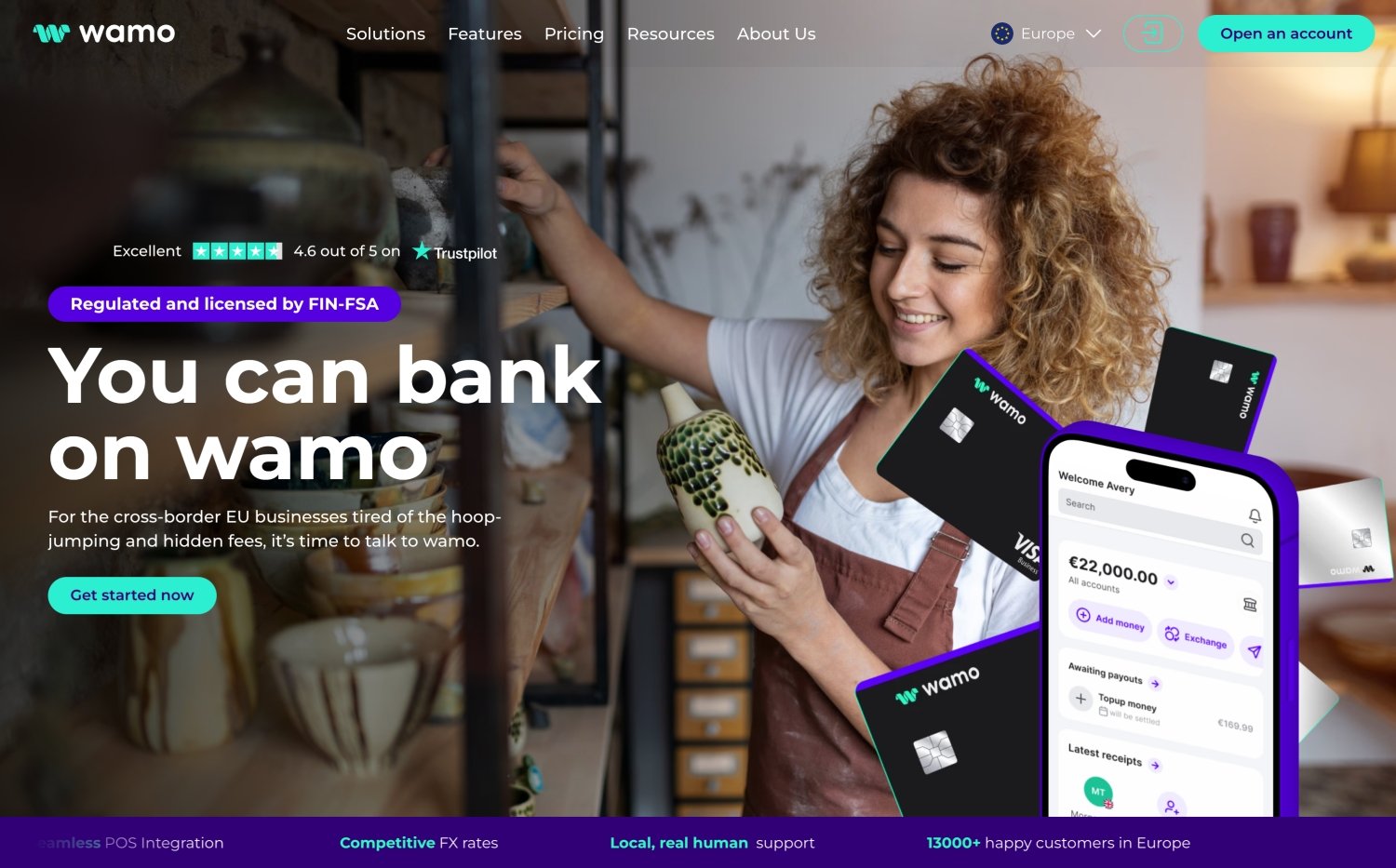

10. Wamo

Wamo is a modern online bank designed for founders who struggle with traditional banking barriers, especially non-EU citizens trying to access banking services in Europe or the UK.

It’s fast, remote-friendly, and removes a lot of the red tape that traditional banks typically throw at global entrepreneurs.

Why Wamo stands out:

- Open a bank account online without visiting a branch

- IBAN access for checking and savings accounts

- Virtual and physical cards

- Designed for founders outside traditional banking ecosystems

Wamo may not be the best bank if you’re looking for high-yield savings accounts or CDs, but for flexible, cross-border banking, especially in the EU, it’s a strong contender among the best online banks of 2026.

Choosing an Online Bank

It’s not just about who has the best interest rate or the flashiest app. Here’s what to think about when you open a bank account online:

Safety First

Make sure the bank is insured, most reputable online banks are FDIC‑insured just like a national bank.

Account Types

Do you need just a checking account, or also a high‑yield savings account? Some banks offer both and integrate them smoothly.

Fees & Minimums

Some online banks may charge fees or have minimum balance requirements. Others are completely fee‑free.

Online Banking Features

Look for bill pay, mobile deposits, integrations with accounting tools, and easy wire transfers.

Business Tools

If you’re running a company, features like team cards, expense tracking, and payroll integrations can be a game‑changer.

How to Open a Bank Account Online in 2026

Opening a bank account online used to sound risky. But in 2026, it’s become one of the fastest, safest, and most efficient ways to get started, whether you’re opening your very first checking account, setting up a high-yield savings account, or switching from a traditional brick-and-mortar bank to something that actually fits your business needs.

The best part? Most online banks make the process incredibly smooth, no paperwork, no awkward meetings, and no “please hold while we transfer you.”

Here’s how to open an online bank account:

#1 Choose the best online bank for your needs

Look for an online bank that fits your business model, whether that’s a solo freelance hustle or a growing startup with a team. Many online banks offer packages designed specifically for small business owners.

#2 Gather your documents

Most online banks typically require:

- A valid government-issued ID

- Your business registration or incorporation documents (if applicable)

- Tax identification number or SSN

- Proof of address

#3 Submit your application online or via app

With platforms like Ally Bank, Quontic Bank, and SoFi Checking and Savings, you can open an online bank account in under 10 minutes. Many top online banks also allow you to start with no minimum balance requirement, especially for savings accounts.

#4 Fund your account

Once approved, transfer funds to your new deposit account. You can often link an existing bank to move money instantly.

#5 Start using your account

Access your online and mobile dashboard, order a debit card (if needed), and start managing your money digitally. Many online banking features include bill pay, rewards checking, and even certificates of deposit (CD account) options, all available without stepping into a branch.

A few quick tips:

Some online banks may take a bit longer to verify business entities, especially if your documents aren’t in English or you’re registering from abroad.

Be sure to review fees or minimum balance requirements, especially on checking and savings accounts.

If you’re looking to earn from your balance, look for an online bank that offers a high-yield online savings account or a rewards checking account.

Are Online Banks Safe?

A common question is: Are online banks safe?

The short answer: Yes.

Many online banks are chartered banks, insured by trusted authorities, and follow strict regulations, just like traditional banks. Online banks also often have strong security features like biometric login and multi‑factor authentication.

So when you open an online bank account, you’re usually getting the same protections you’d expect from an in‑person bank, just without the waiting room.

Online vs Traditional Banks

Traditional banks (the ones with physical branches) still exist and serve millions. They often provide more in‑person services and sometimes access to loans or local support.

But online banks also allow faster onboarding, lower fees, a better interest rate on savings, and modern tools that work well with remote team workflows.

In 2026, many businesses use a hybrid approach:

✔️ Online bank for day‑to‑day transactions

✔️ Traditional bank for large loans or financing needs

Find the Best Online Bank for You

There’s no one‑size‑fits‑all answer when it comes to the best online banks of 2026. The right bank for a global SaaS founder might be different from one used by a freelance graphic designer.

The good news?

Online banks make it easier than ever to open a bank account online, often in minutes, and start managing your money like a pro.

Here’s a quick recap of how to find the best online bank:

- Consider your priorities (interest, fees, team features)

- Think about how you’ll use the account

- Evaluate both checking and savings options

- Check whether the bank offers the tools you need

Whether you choose Wise, Revolut, Payoneer, Ally Bank, or any of the other top names on this list, the most important thing is that the bank works for you, not the other way around.

Happy banking!

FAQs: Online Banks in 2026

1. Can I open both a checking and savings account with an online bank?

Yes, many online banks offer both a checking account and a savings account as part of a bundled experience. In fact, several of the best online banks of 2026 provide checking and savings account combos that are more flexible and rewarding than those offered by traditional banks and credit unions.

Platforms like SoFi Checking and Savings and Ally Bank let you manage both accounts from a single dashboard, set up automatic transfers between them, and even earn interest on your checking balance. If you’re looking for the best possible experience, having both accounts in one place can really streamline your business finances.

2. What kind of banking products do online banks usually offer?

While online banks don’t always offer everything that a national bank might, they’ve come a long way. The banking products and services you’ll typically find include:

- Checking accounts

- High-yield savings accounts

- Certificates of Deposit (CDs)

- Rewards checking accounts

- Expense tracking and team cards (for business accounts)

Some online banks may even offer small business loans or credit lines, though this varies by provider. For example, Quontic Bank is a full-service online bank that also offers mortgage products, while Axos Bank has tailored lending options for startups.

3. Are online banks insured like traditional banks?

Yes, the best online banks are insured just like traditional brick-and-mortar banks. Most are members of the FDIC (Federal Deposit Insurance Corporation) or a similar regulatory body, which means your deposit account is protected up to $250,000 per depositor, per bank.

This means the online bank you’re using is just as safe as traditional banks, as long as it’s properly chartered and insured. Always check a bank’s website for FDIC membership or equivalent regulatory details before opening an account.

4. Do online banks offer better interest rates than traditional banks?

Generally speaking, yes. The interest rate offered by online banks is usually higher than what you’d get at a traditional bank. That’s because online banks typically have lower overhead costs (no branches to maintain), allowing them to pass those savings to customers via higher APYs (Annual Percentage Yields).

If you’re looking for the best high-yield savings accounts, banks like Ally Bank, Quontic Bank, and First Internet Bank consistently rank among the top online banks. Many online banks provide better rates on savings account and CDs, making them a smart choice for both personal and business savings goals.

5. How long can I lock in a CD account with an online bank?

Great question, many online banks offer certificates of deposit (CDs) with terms ranging from as short as three months to 10 years. This gives you flexibility based on your savings strategy.

Some banks even provide high-yield savings account alternatives that offer liquidity along with competitive interest rates, so you’re not completely locked in. Whether you’re looking for long-term growth or short-term returns, the banks of 2026 offer far more options than they used to, and often with fewer minimum balance requirements than traditional providers.

If you want to explore options, Quontic Bank and Ally Bank are two excellent choices for CD accounts in 2026.

What do you think?

Show comments / Leave a comment